CMI researchers at Colorado School of Mines conducted the research for this highlight

Achievement

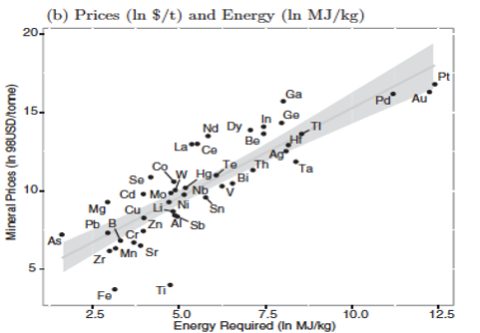

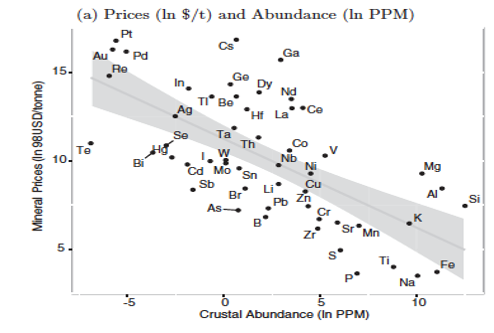

- Evaluates the role of crustal abundance, energy requirements in production and other physical indicators in determining relative metal prices – within an economic market model.

- Based on a sample of 22 chemical elements over the period 1970-2013.

Significance and Impact

- Finds that energy requirements explain 43% of observed variation in prices, crustal abundance 21% and other physical factors 12%.

- Implies that research in material science should give greater priority to reducing energy inputs to material production than to using elements with relatively high average crustal abundance.