CMI researchers from Colorado School of Mines conducted the activity for this highlight

Innovation

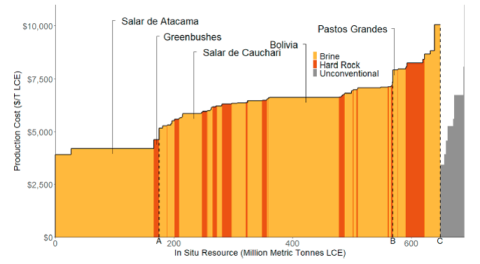

Estimating the quantities and associated production costs of known lithium resources, updating and extending a 2009 evaluation.

Achievement

Using a cumulative availability curve to summarize estimates of quantities, costs, and locations of 150 conventional and unconventional lithium deposits.

Significance and Impact

- Known, in-situ resources more than doubled between 2009 and 2023.

- An incentive price in the range of $12,500 to $15,000 is implied – i.e., the long-run price necessary to incentivize investment to bring these resources into production.

Hub Target Addressed

Enhancing criticality assessment to make it more forward looking.